CAC News

Hanoi, October 28, 2025 — The global cashew industry is witnessing a major shift as African nations accelerate local processing of raw cashew nuts (RCN), directly challenging Vietnam’s long-standing dominance in the sector. Industry experts warn that this emerging trend could reshape global supply chains and tighten profit margins for leading processors.

Vietnam currently processes over six million metric tons of raw cashew nuts annually but produces only 300,000 tons domestically, making it heavily dependent on RCN imports from key African suppliers such as Ivory Coast, Nigeria, Benin, and Ghana. However, as these African nations increasingly focus on developing their own processing industries, Vietnam’s reliance on imported RCN is becoming a significant vulnerability.

“This shift will heighten global competition and compress profit margins across the industry,” said Nguyen Minh Hoa, Vice President of the Vietnam Cashew Association (VINACAS), during a recent industry conference.

Africa’s Strategic Push

According to Berté Mamadou, representative of the Ivory Coast Cashew Council (CCA), Africa’s move toward local processing is part of a broader economic strategy aimed at boosting industrial growth, creating jobs, and reducing logistics costs. “Many foreign investors, including Vietnamese firms, are already operating in West Africa,” Mamadou noted, adding that collaboration remains a key element of the continent’s growth plan.

In Nigeria, the world’s Fourth-largest cashew producer, policy reforms are seen as crucial to attracting investors. Ademola Adesokan, President of the National Cashew Association of Nigeria (NCAN), urged the government to fast-track the approval of long-pending cashew industry policies. “Nigeria is already eight years behind,” Adesokan cautioned, warning that delays could cause the country to miss out on the current wave of investment opportunities.

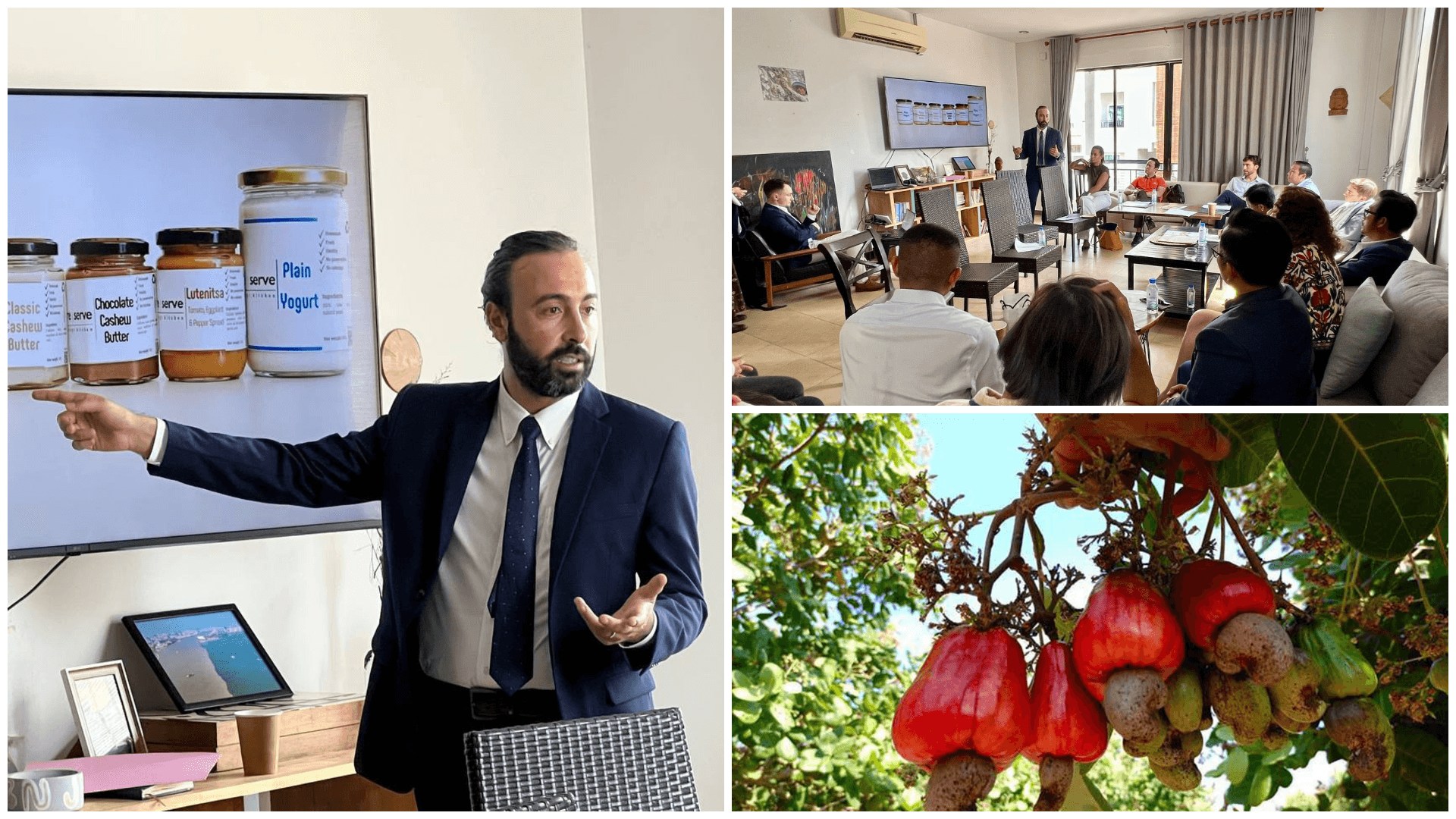

Collaboration or Competition Ahead

The conference concluded with calls for stronger cooperation between African and Asian producers through technology transfer, joint investment, and standardized quality frameworks. Whether these two major producing regions choose partnership over rivalry will determine the future balance of power in the global cashew industry.

Meanwhile, Silot Uon, President of the Cashew Nut Association of Cambodia, highlighted Cambodia’s growing role as a key supplier to Vietnam’s processing sector. The country is projected to produce one million tons of RCN by 2025, most of which is exported to Vietnam.

“Cambodia may not directly compete with Vietnam in the next 15 years,” Silot said, “but we can certainly serve as a strong partner, fostering mutual growth and sustainable collaboration.”

As Africa’s processing capacity expands and Asia’s dominance faces new challenges, the global cashew market stands at a crossroads—one that could redefine trade relationships, investment flows, and industry leadership for years to come.

Reference: J Rajmohan Pillai Chairman @ Beta Group | Business Management Doctorate